arizona maricopa county tax lien

Auction properties are updated daily on Parcel Fair to remove redeemed properties. Your property may be subject to additional tax liens listed under previous parcel numbers.

2022 Tax Sale Details.

. Maricopa County Treasurers Office. Send a completed order form with your payment of 2500 personal or business check cashiers check or money order to. Maricopa County AZ currently has 13 tax liens available as of March 9.

Arizona has 15 counties and in Maricopa County alone they could have 15000 or more tax lien certificates available. Please allow 2-3 weeks for the full release to post with the appropriate County Recorders Office andor Secretary of State. 4 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales.

Arizona Department of Revenue 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be provided within 24 hours to the taxpayer. Liens and Research. Ad Ownerly Helps Homeowners Find Data On An Address Lien Owner Info More.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. 2021 Tax Due. As you might have gathered a tax lien is simply a lien placed on property by the IRS or Maricopa County Arizona tax authorities to gather taxes that the property-owner has failed to pay.

The Tax Lien Sale will be held on February 9 2021. Maricopa County Arizona tax lien certificates are sold at the Maricopa County tax sale annually in the month of February. However like any other debt-collection method a tax lien is worthless if the debtor has no substantial property on which a lien can be imposed.

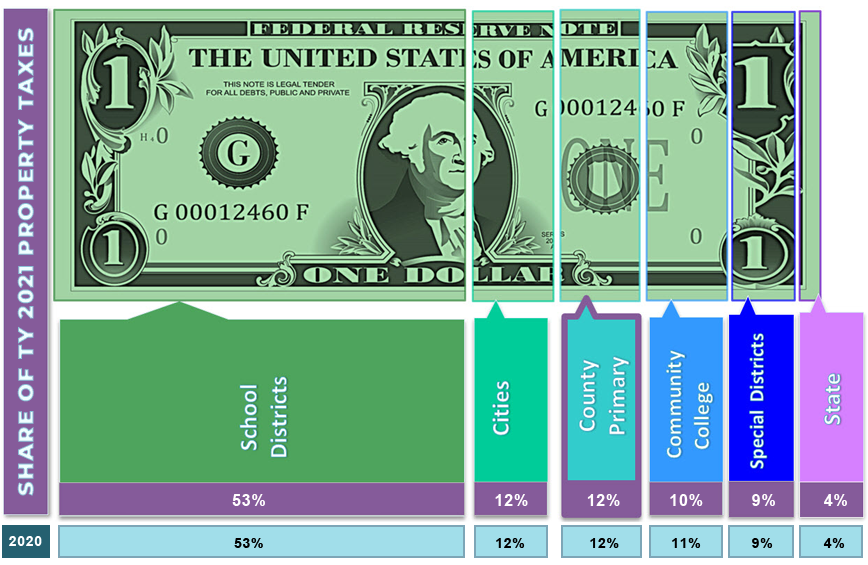

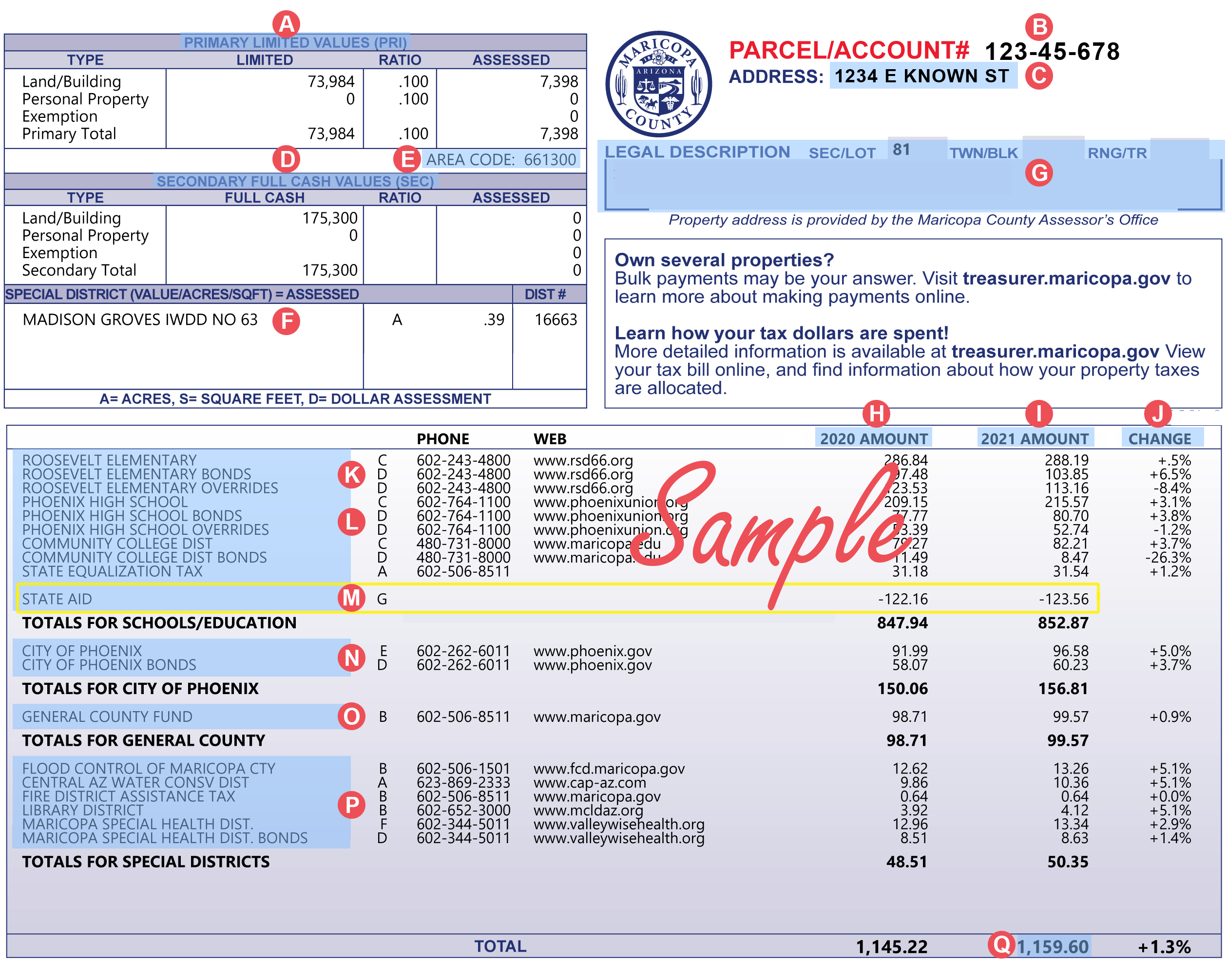

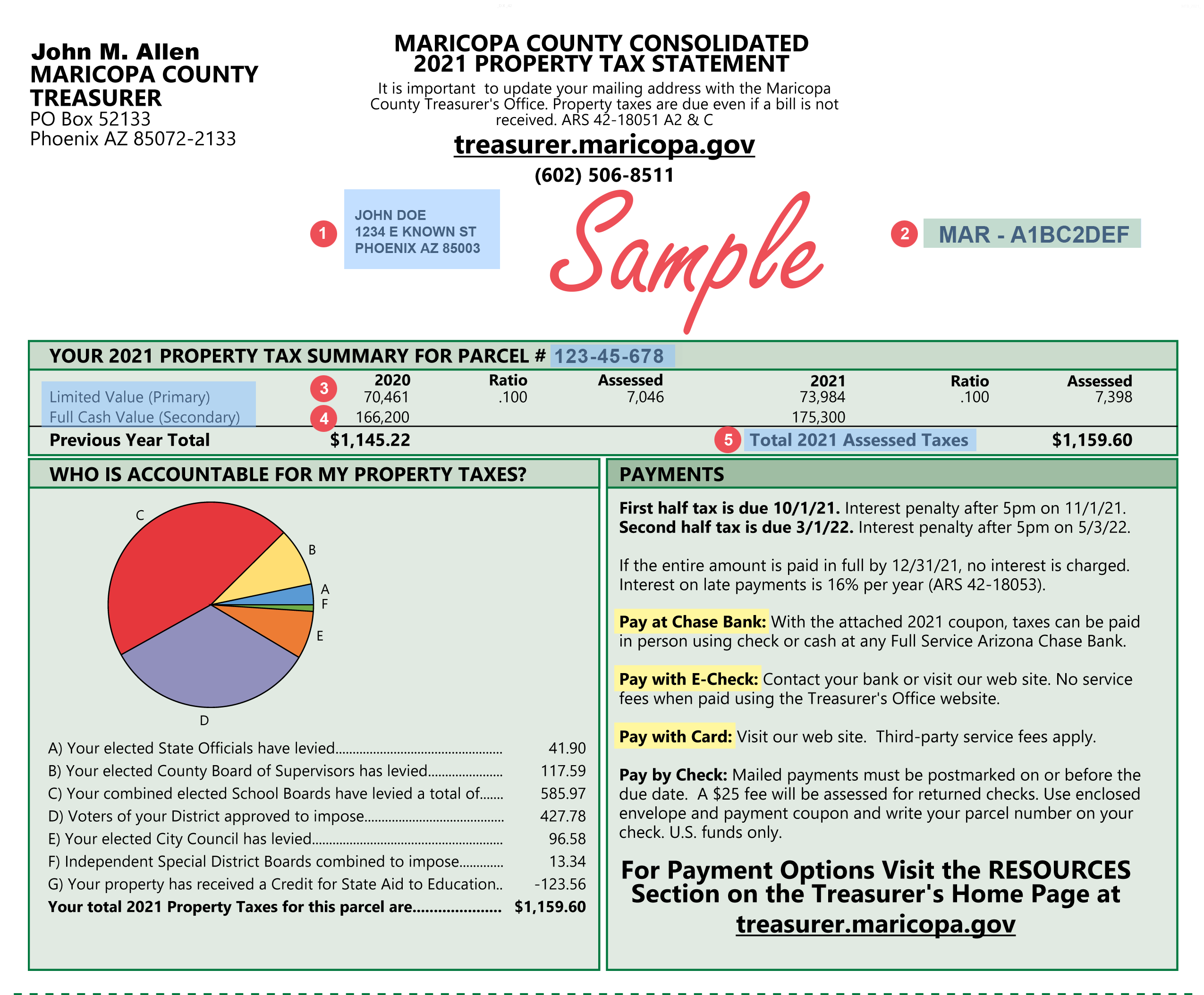

The Maricopa County Supervisors only control a small portion of the property tax bill. For additional information on Tax Deeded Land Sales you may contact the Treasurers Office at. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022.

The Court adjudicates cases involving state taxes municipal sales taxes and property taxes as well as appeals from the Property Oversight Commission. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. Tax Lien Statistics - as of 4252022.

Perform a Complete Property Record Scan in Less than Two Minutes. The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services. Property Situs Address.

If you do not have access to a computer the Treasurers Office will provide public access computers by appointment at designated locations. The Treasurers tax lien auction web site will be available 1252022 for both research and registration. Arizona Revised Statutes Title 42 - Taxation Chapter 18.

Tax Lien Department 301 W. To file your judgment with the Clerks Office you must provide us with a certified copy of your Justice Court judgment and civil cover sheet. We hope you enjoyed Teds lesson How to Buy Tax Liens in Maricopa County.

See Available Property Records Liens Owner Info More. When you purchase tax lien certificates youre investing with the government and getting paid by the government making it one of the safest investments in America. Search Any Address 2.

Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and. Ad Find Out If a Property Has Any Registered Liens Before Making an Offer.

It truly is a business of abundance. Click here to download the available State CP list. Register for 1 to See All Listings Online.

Maricopa County AZ currently has 17567 tax liens available as of April 28. Maricopa County Treasurers Property Information System. Sold liens includes liens sold at the tax sale subtax and assignment liens.

Maricopa County Treasurer Attention. Ad Buy Tax Delinquent Homes and Save Up to 50. Jefferson Street Suite 140 Phoenix AZ 85003-2199 Please use the format below when submitting a purchase request.

Delinquent and Unsold Parcels. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. To create a lien using a judgment from a Justice Court the County Recorders Office requires a certified copy of the judgment after it has been filed with the Clerk of Superior Court.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Map of Parcels with Overdue Taxes. On a CD from the Research Material Buying Guide available at the beginning of January.

1018 E PORTLAND ST PHOENIX AZ 85006. 2 Maximum interest rate is 16. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or collection of a tax.

You can now map search browse tax liens in the Yavapai Coconino Apache and Maricopa 2022 tax auctions. 95 to 97 of the certificates are redeemed however if you dont get paid you get the property with no mortgage or deed of trust loan making Maricopa County tax. 1 Parcels may be advertised but not auctioned because of pending litigation such as bankruptcy.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. 602-506-8511 or the Clerk of the Boards Office at. The Maricopa County Treasurer sends out the property tax bills for local jurisdictions this includes the county cities school districts special taxing districts and the state not just Maricopa County based on the assessed values and the calculated rates.

3 Parcels are struck to state and become state liens if the tax lien is not purchased at the sale. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Visit Arizona tax sale to register and participate.

Maricopa County Treasurer co Research Material Purchasing. Preview and bidding will begin on January 26 2021.

Arizona House Speaker Casts Doubt On Plan To Break Up Maricopa County

Amazon Com Maricopa County Arizona 48 X 36 Paper Wall Map Home Kitchen

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Arizona Federal Loan Information Fhlc

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate Ktar Com

Amazon Com Maricopa County Arizona Zip Codes 48 X 36 Matte Plastic Wall Map Office Products

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Maricopa County Island What Is It Arizona Homes Horse Property

Get A Look At Phoenix And Nearby Cities In Maricopa County Avondale Arizona Maricopa County Arizona

Pin By David Vance On Patches Police Patches Vintage Patches Patches For Sale

City Limits Maricopa County Az

Pay Your Bills Maricopa County Az

Allister Adel Is New Maricopa County Attorney Until January 2021 Phoenix New Times

Maricopa County Zip Code Map Area Rate Map Zip Code Map Metro Map Map

Maricopa County Clerk Maricopaclerk Twitter

Displaced In America Housing Loss In Maricopa County Arizona